Liverpool FC to Change Ownership – Again?

Reports over the weekend claim that an £800m bid for Liverpool Football Club has been made by a Chinese government-backed investment fund.

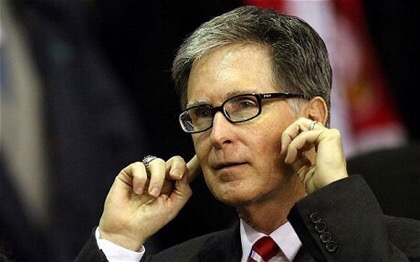

The news comes despite an article in the Liverpool Echo quoting Fenway Sports Group (FSG) co-owner Tom Werner, dismissing the topic of selling the club. Personally I’m a believer that everybody has his price. The size of the bid would lead me to conclude that FSG’s has possibly been met.

In view of the fact the current owners paid a reported £300m for the club, it’s easy to understand why one would be sceptical of Werner’s statement. In these times of financial strife and global austerity, I couldn’t see any sensible business – which I’m sure FSG would purport to be – turning this down. A return of 266% is certainly not to be sniffed at. As the character Tom (funnily enough) in Lock, Stock and Two Smoking Barrels said: “It’s a deal, it’s a steal, it’s the sale of the f@&king century…”

According to the Sunday Times yesterday an investment bank has been appointed to advise of the potential sale of a significant stake in the club. Not exactly in accord with what Mr. Werner claims. OK, they’re not selling the club per se, but there could be a material change in the ownership and board structure at Liverpool FC. Let’s not beat around the bush here. We don’t need to play on words.

It’s possible that a huge investment could be made in the club. Whether that’s by an outright or partial sale. This could represent a huge change in direction for the club. What would be the approach? Similar to that of Manchester City one presumes. What would that mean for resident rough-diamond-polisher and manager Jürgen Klopp? Would he be entrusted to morph into a “super manager”? Or would this mean a new direction?

These are just a couple of the questions that come to mind. Let alone who actually are Everbright Ltd.? Yes, their website mentions: “Everbright uphold the “big asset management” strategy, focusing on the development of a market funds, secondary market funds, structured finance and investment fund management and investment business, as China Aircraft Leasing Group Holdings Ltd’s main shareholder, and actively develop China aircraft leasing business in emerging markets.” But with 25 years’ experience in Finance and Commodities markets, I can tell you, that means very little. How do they define “big asset management”?From aircraft leasing to football, explain? Given the fact that a bank has been appointed by FSG to advise on discussions, I think Werner and FSG owe the fans more than a clichéd, scripted out response to what could be a massive change.

Change is clearly required. If asked – which of course I wouldn’t be – I’d like an arrangement without a sale. It’s been mooted that John W. Henry could retain a place on the new “board” and this continuity of sorts would be welcome. As well as FSG retaining a significant stake. However, it’s unlikely an Everbright minority stake could work that way in practice.

My personal opinion is that should this all have substance, then it should be pursued. Liverpool in reality can’t currently compete. Yes, they have money, this is clear, but not the kind that’s need to stand toe-to-toe with those setting the current trends. Man City, Chelsea and as much as I loathe to mention them, Manyoo.

The weekends result against Burnley was not simply down to poor “decision making”. It was decisions that were made by inferior players. This is the cold, hard truth of the matter. This is why LFC needs to step up to avoid fading into history.

Follow us on Twitter: @TheLFCFile